Global Market Overview

01

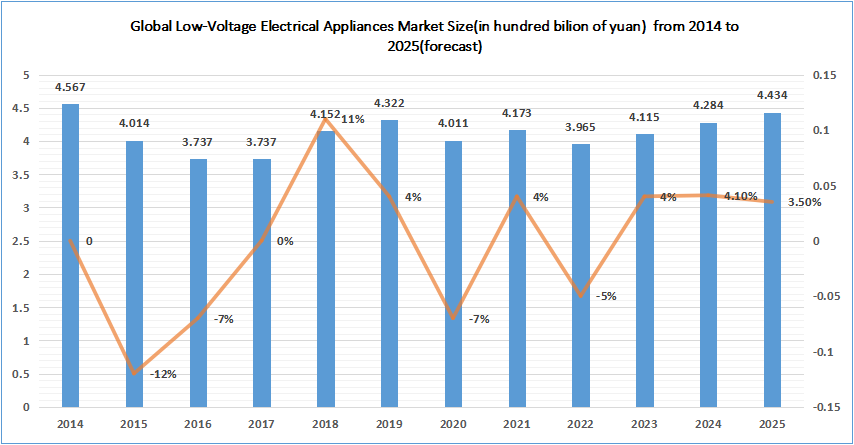

Global Low-Voltage Distribution Market Size

2014-2025 Global Low-Voltage Electrical Appliances Market Size

Source of data:Internet

2024 Global Low-Voltage Electrical Appliances Market Overview

In 2024, the global low-voltage electrical equipment market reached a scale of RMB 4.284 hundred billion, reflecting a year-on-year growth of 4.1%, driven significantly by contributions from regions such as North America, Europe, and Southeast Asia. With the ongoing recovery of the global economy and the maturation of product technologies tailored to emerging sectors—such as new energy infrastructure and smart grid development—the market is projected to maintain a stable compound annual growth rate in the coming years.

North America: The region’s short-term economic outlook remains positive, supported by low unemployment rates and proactive fiscal policies, which have bolstered demand for low-voltage electrical equipment in construction and industrial sectors. Initiatives like U.S. infrastructure investments and manufacturing reshoring have further stimulated market growth.

Europe: Sustained demand for energy transition (e.g., wind and solar power distribution) and industrial upgrading, coupled with stringent green building standards, continues to drive the adoption of energy-efficient low-voltage electrical equipment.

Southeast Asia: Infrastructure development (e.g., data centers, factory construction), manufacturing relocation, and foreign direct investment (FDI) inflows have fueled demand for low-voltage electrical products, positioning the region as a “new engine” for global market growth. Notable examples include factory expansions in Vietnam and grid modernization projects in India, which have spurred large-scale procurement of circuit breakers, contactors, and related products.

Global Market Competitive Landscape

2024 Market Share Distribution

The top four to five companies in the global low-voltage electrical equipment market are multinational corporations headquartered in Europe and the U.S., with extensive business portfolios spanning diverse sectors. Leveraging their global diversification strategies—particularly in AI, intelligent computing, and high-performance computing—these enterprises demonstrate strong capabilities in localized production, R&D innovation, and service support.

Chint Group: The Chinese firm has exhibited robust and steady growth in overseas markets, characterized by diversified business expansion, deepening regional presence, progressive localization strategies, technology-driven innovation, and rising brand influence.

LS Electric: The company has established a broad operational network across the Middle East, North America, and Southeast Asia, while also making significant inroads into the European market.

Delixi: The group implements a multi-brand strategy internationally, with brands such as Delixi Electric, Himel, Steck, and Gunsan.

Regional variations remain pronounced, with certain markets dominated by local brands. Due to potential limitations in statistical methodologies, some discrepancies in market share reporting may exist. Nevertheless, industry data indicates that the combined market share of the top-tier enterprises exceeds 55%.

Post time: Jul-23-2025